Financial Advisor Meeting Checklist: What to Bring, Prepare, and Expect

Meeting with a financial advisor is a critical step toward achieving long-term financial security. But the value you get from the financial advisor meeting largely depends on how well you prepare. From gathering the right financial documents to clarifying your goals, this financial advisor meeting checklist helps ensure a productive and empowering experience.

How to Prepare for Your Financial Advisor Meeting

Preparation sets the foundation for a meaningful conversation. Knowing how to prepare for a financial advisor meeting ensures you make the most of your time and walk away with clear, personalized advice.

Whether it’s your first meeting with a financial advisor or an annual review, these steps will help.

Set Clear Goals

Define what you want to achieve. Are you saving for retirement, planning a home purchase, or reducing debt? Clarifying your short- and long-term goals helps your financial advisor craft an actionable plan.

This is a key part of how to prepare for the first meeting with a financial advisor and it allows the conversation to stay goal-oriented.

Understand Your Financial Picture

Have a general understanding of your income, savings, debts, and investments. This lets you speak more confidently and allows your financial advisor to assess your current position accurately.

It’s another step in how to prepare for a meeting with a financial advisor that leads to better financial advice and planning.

Organize Key Information Ahead of Time

Use folders or digital tools to organize your financial paperwork. Whether printed or electronic, ensure everything is accessible and up to date. Having these items ready is essential to any checklist for a meeting with a financial advisor.

What to Know Before Meeting With a Financial Advisor

Before your meeting with a financial advisor, it’s important to know that the conversation will center around your goals, income, debts, assets, and future plans. You don’t need to have perfect financial knowledge, but you should be ready to discuss your financial habits, any major life events, and what you hope to achieve.

Also, know that not all financial advisors offer the same services — some focus only on investments, while others provide comprehensive financial planning. Understanding their role, fee structure, and fiduciary duty will help you ask a financial advisor the right questions and get the most value from your meeting.

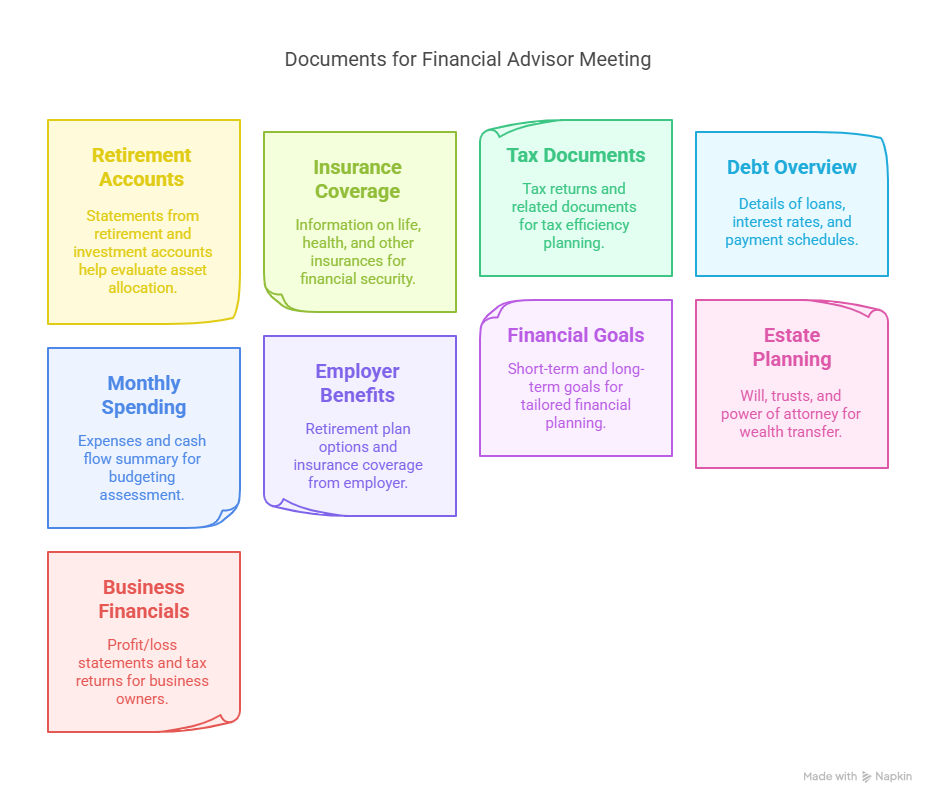

What to Bring to Your Financial Advisor Meeting

The more complete your documentation, the better your financial advisor can guide you. If you’re wondering what to bring to financial advisor meetings, use the categories below to prepare.

Retirement and Investment Account Statements

These help your advisor evaluate asset allocation and tax efficiency—key parts of a comprehensive meeting with a financial advisor.

- 401(k) plans

- IRAs

- Other retirement accounts

- Investment/brokerage accounts

- Savings and checking accounts

- Any additional financial or custodial accounts

Insurance Coverage Information

Insurance planning is a core part of financial security, especially in retirement.

- Life insurance

- Health insurance

- Long-term care insurance

- Disability insurance

- Employer-provided benefit summaries

- Pension details or rollover options

Tax Documents

Tax efficiency can significantly affect investment decisions and withdrawal strategies.

- Most recent federal and state tax returns (1040 and schedules)

- W-2s and/or 1099s

- Capital gains or losses (Schedule D)

- Documentation for any large financial events (inheritance, home sale, etc.)

Debt Overview

Advisors need a full picture of your liabilities to create a realistic financial plan.

- Loan types and principal balances

- Interest rates

- Monthly payments

- Payoff timelines

- Credit cards, mortgages, student loans, personal loans

Monthly Spending & Cash Flow

This information helps your advisor assess budgeting opportunities and cash flow planning.

- Last 6–12 months of expenses

- Summary of average monthly expenses by category

- Optional: recent budget or spending tracker export

Employer Benefits Information

Contact your HR or benefits department to gather:

- Retirement plan options (401(k), pension, rollover info)

- Employer-provided insurance (health, life, disability)

- Coverage details and benefit amounts

Financial Goals and Priorities

Sharing these allows the advisor to tailor your plan to what matters most to you.

- Short-term goals (e.g., save for a house, pay down debt)

- Long-term plans (e.g., retirement, college funding)

- Lifestyle milestones (travel, moving, large purchases)

Optional: Estate Planning Documents

Important if you’re focused on wealth transfer, family security, or advanced planning.

- Your will

- Any trusts

- Powers of attorney

- Beneficiary designations

Optional: Business Financials

Essential if you're self-employed or run a business.

- Profit & loss statements

- Business tax returns

- Asset/liability overviews

- Business retirement plans (SEP IRA, Solo 401(k))

These documents are essential when thinking about “what information does a financial advisor need”.

Where to Find the Documents You Will Need For the Meeting with a Financial Advisor

If you're assembling materials for your meeting with a financial advisor for the first time, here's where and how to find essential documents your financial advisor will need for the meeting:

- Bank and Investment Account Statements

- Log in to your bank or investment platform (e.g., Fidelity, Vanguard, Schwab). Look under “Statements” or “Tax Documents.”

- Retirement Account Information

- Check your plan provider’s portal (e.g., your employer's 401(k) administrator) or contact your HR department.

- Insurance Policies

- Contact your insurer or employer benefits department. Many policies are available through customer portals or HR platforms.

- Tax Documents

- Use your tax preparation software (TurboTax, H&R Block) or contact your accountant. IRS transcripts are also available online.

- Debt and Loan Information

- Access loan servicer portals (student loans, mortgage lenders, credit cards) for statements, balances, and interest rates.

- Employer Benefits Information

- Request a benefits package or summary plan descriptions from your HR department.

What to Expect During Your First Meeting with a Financial Advisor

Your initial meeting with a financial advisor is the foundation of your financial planning relationship. It’s designed to gather information, build rapport, and outline the next steps in creating a financial strategy that works for you. Here's what typically happens during that first session:

Comprehensive Review of Your Financial Situation

The financial advisor will go over your income, assets, debts, insurance, spending, and tax documents to understand your current financial standing. This includes reviewing the paperwork you’ve brought and asking clarifying questions.

Discussion of Your Personal Goals and Risk Tolerance

Expect a conversation about where you are now and where you want to be—both in the short term (e.g., buying a home, paying off debt) and long term (e.g., retirement, legacy planning). You’ll also discuss your comfort level with risk to help shape your investment strategy.

Introduction to a Personalized Financial Strategy

The financial advisor may provide an initial assessment or framework based on your documents and goals. While it’s not a final plan, it helps you see what areas may need attention—budgeting, investment adjustments, insurance gaps, etc.

Clear Explanation of Fees and Services Offered

A trustworthy advisor will explain exactly how they’re compensated (fee-only, commission-based, or both), what services they provide, and what ongoing support looks like.

Defined Action Items and Next Steps

You’ll leave the meeting with a summary of what was discussed, a list of any additional documents needed, and next steps—such as scheduling a follow-up or receiving a draft financial plan.

This first meeting with your financial advisor is both a diagnostic and a dialogue. Use it to assess whether the financial advisor’s communication style, values, and expertise align with your needs.

How to Meet with a Financial Advisor Confidently

Feeling confident in your meeting with a financial advisor starts with the right mindset and a willingness to engage openly. Remember: you're not there to impress your financial advisor—you're there to empower yourself with information and guidance.

1. Don’t be afraid to ask questions.

Your financial advisor works for you. It’s their job to explain complex terms, strategies, and products in a way that makes sense. If something is unclear, speak up. You’re not expected to know everything. For guidance, check out our list of questions to ask a financial advisor.

2. Be transparent about your financial situation.

Honesty is key. Hiding debts, skipping details, or overestimating your income can lead to a financial plan that doesn’t reflect reality—and that won’t serve you well. Even if your finances are messy, a good advisor is there to help, not judge.

3. Take notes and ask for clarification.

You may hear new terminology, acronyms, or concepts. Write down anything you don’t understand and ask the advisor to break it down. This ensures you're not just listening, but truly understanding and taking ownership of your financial future.

4. Stay engaged and treat it as a two-way conversation.

This isn’t a lecture—it’s a collaboration. Ask follow-up questions, challenge assumptions if something doesn’t align with your goals, and use the meeting to actively shape your plan.

Confidence doesn’t come from having all the answers—it comes from being willing to ask the right questions.

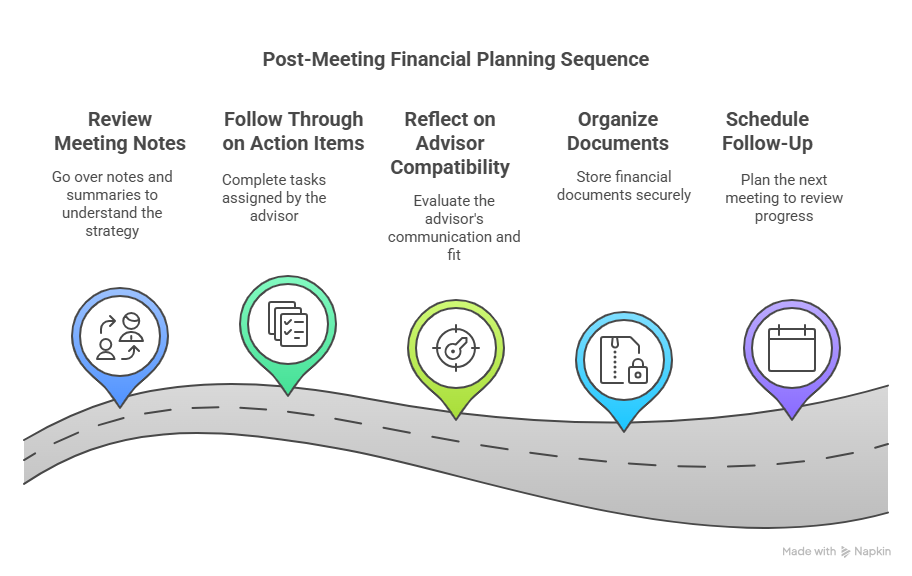

What to Do After Meeting with a Financial Advisor

The meeting doesn’t end when you walk out the door or log off the video call—what you do afterward is just as important as what happened during the session. The post-meeting phase is where you begin putting your financial plan into action – an essential outcome of a productive financial advisor meeting – and evaluating whether the financial advisor is the right long-term partner.

Review the meeting notes and key takeaways.

Go over any written notes, handouts, or digital summaries your advisor provided. Make sure you understand the proposed strategy, next steps, and any unfamiliar terms.

Follow through on assigned action items.

Your financial advisor may have asked you to gather additional documents, update beneficiaries, consolidate accounts, or review specific parts of your financial life. Completing these tasks promptly ensures the planning process stays on track.

Reflect on the advisor's communication and compatibility.

Were they clear, respectful, and attentive to your needs? Did you feel heard? Your financial advisor should be someone you trust—not just for their expertise, but for how they treat your goals and values.

Organize your documents and track progress.

Store your financial documents in a secure, easy-to-access place (physically or digitally). Consider creating a checklist or using a financial app to track any recommendations being implemented.

Schedule your follow-up meeting or check-in.

Financial planning is ongoing. Whether quarterly or annually, routine reviews help keep your strategy aligned with your evolving goals and life events.

Taking action after the meeting with your financial advisor ensures your time and preparation translate into measurable progress—and that you stay in control of your financial journey.

Red Flags to Watch Out For When Meeting With Your Financial Advisor

While most financial advisors aim to provide honest, client-centered advice, not all operate with the same level of transparency or integrity. It's important to stay alert to potential warning signs during your financial advisor meeting—especially if you're evaluating a new financial advisor.

These red flags may indicate conflicts of interest, lack of qualifications, or poor alignment with your financial goals:

- Vague or evasive answers about fees or compensation.

- Pressure to buy specific financial products.

- Lack of transparency or unclear credentials.

- Dismissive attitude or failure to listen.

- Promises of guaranteed high returns.

- Unwillingness to provide documentation or references.

Your financial advisor should be a partner, not a salesperson. If anything feels off, don’t ignore your gut—consider seeking a second opinion or continuing your search for the right financial fit.

Conclusion

Your financial future deserves preparation, clarity, and confidence. By using this financial advisor meeting checklist, you’ll show up ready to make the most of your time and leave with a clearer path forward. Whether it’s your first meeting with a financial advisor or a check-in on your evolving goals, good preparation leads to great outcomes.

FAQ

What help should I expect from a Financial Advisor?

You should receive personalized advice on budgeting, investing, retirement, insurance, estate planning, and goal tracking—plus support in navigating complex financial decisions.

How often should I meet with my financial advisor?

Most clients meet annually, but major life changes (marriage, job change, inheritance) may require more frequent updates.

Can I bring my spouse or a friend to the meeting with a financial advisor?

Yes, especially if you make financial decisions jointly or want someone to help you process the information.

How long do financial advisor meetings last?

Initial meetings typically last 60–90 minutes, while follow-ups may take 30–60 minutes.

What questions will a financial advisor ask me?

They may ask about your income, savings, goals, investment preferences, debts, and lifestyle expectations.

Most read

Subscribe to our newsletter

Get the latest on finding, evaluating, and working with financial advisors; delivered right to your inbox.

The content of video and blog articles are for informational and entertainment purposes only and do not constitute investment, tax, legal, or financial advice. Always consult with a qualified professional before making any financial decisions. The views expressed are those of the author and do not reflect the opinions or recommendations of any affiliated entities.